Income Required To File Taxes 2024

Income Required To File Taxes 2024. If you have income below the standard deduction threshold for 2023, which is $13,850 for single filers and $27,700 for those married filing jointly, you may not be required to file a. If your gross income exceeds the required filing threshold, you must file taxes.

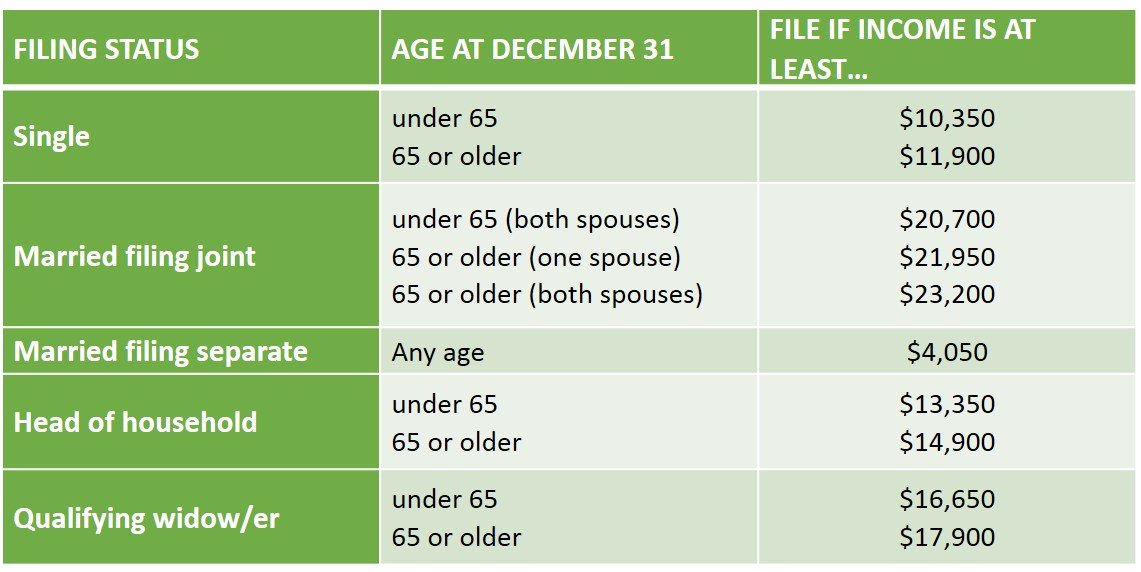

The income thresholds for 2024 (for 2023 tax year filing), are detailed in the irs’s 1040 instructions, and are as follows: As of january 29, the irs is accepting and processing tax returns for 2023.

Your Gross Income Is Over The.

But there are several exceptions to that rule.

The Tax Filing Deadline Is Tuesday, April 15, 2024.

The income thresholds for 2024 (for 2023 tax year filing), are detailed in the irs’s 1040 instructions, and are as follows:

Here Are The Irs Filing Thresholds By Filing Status:

Images References :

Source: mazumausa.com

Source: mazumausa.com

Tax Checklist What Your Accountant Needs to File Your, If you have income below the standard deduction threshold for 2023, which is $13,850 for single filers and $27,700 for those married filing jointly, you may not be required to file a. But there are several exceptions to that rule.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, To determine if you’re one of the millions who have to file a return, start with three things: The income thresholds for 2024 (for 2023 tax year filing), are detailed in the irs’s 1040 instructions, and are as follows:

Source: agtax.ca

Source: agtax.ca

When Should You File A U.S. Federal Tax Return Aylett Grant, Here’s a brief overview for the 2023 tax year, showcasing the minimum income required to file taxes based on your filing status and age: But there are several exceptions to that rule.

Source: pgaca.in

Source: pgaca.in

A COMPREHENSIVE GUIDE FOR TAX RETURN FILLING, If you have income below the standard deduction threshold for 2023, which is $13,850 for single filers and $27,700 for those married filing jointly, you may not be required to file a. For most of us, tax day — the last day to file a 2023 federal income tax return — is april 15, 2024.

:max_bytes(150000):strip_icc()/TaxFilingChart-b3b0026b04464a8da66bcf7c9e479b65.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Do I Have to File Taxes?, The federal income tax has seven tax rates in. Your gross income is over the.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The agency expects more than 128 million returns to be filed before the official tax. The irs plans to pilot a program in 2024 that will allow taxpayers to file directly with the agency for free — regardless of income.

.jpg?width=1667&name=tax graphic_2020 (1).jpg) Source: www.churchillmortgage.com

Source: www.churchillmortgage.com

What to Expect When Filing Your Taxes This Year, Here’s a brief overview for the 2023 tax year, showcasing the minimum income required to file taxes based on your filing status and age: Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year.

Source: www.jspartners.com.my

Source: www.jspartners.com.my

Step by Step Tax eFiling Guide, The irs has a variety of information available on irs.gov to help taxpayers,. Explore other options for free tax filing if you're not eligible for free file, there's still.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year. Citizens or permanent residents who work in the u.s.

Source: enterslice.com

Source: enterslice.com

Tax Return Filing Online ITR Filing Eligibility Enterslice, Single minimum income to file taxes in 2024: As of january 29, the irs is accepting and processing tax returns for 2023.

You Probably Have To File A Tax Return In 2024 If Your 2023 Gross Income Was At Least $13,850 As A Single Filer Or $27,700 If Married Filing Jointly.

The tax filing deadline is tuesday, april 15, 2024.

Explore Other Options For Free Tax Filing If You're Not Eligible For Free File, There's Still.

How to file and submit your tax.